buy and build private equity

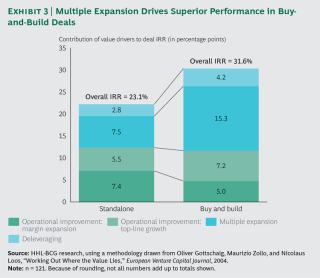

According to The Power of Buy and Build. A buy and build strategy is commonly used by private equity firms seeking to expand operations generate value and increase returns.

Private Equity Firms Buy Vs Build Conundrum Acuity Knowledge Partners

Hire Buy-and-Build Consultants in 48h Fintalent They take time to know your business and investment objectives.

. Growth by business acquisition If youre looking to carry out a business acquisition or continue a buy and build strategy private equity can help. Many private equity firms today employ aggressive buy and build strategies to accelerate growth. Private equity firms generally use this strategy more often than anyone else but it is also used by strategic buyers publicly traded companies and closely held businesses.

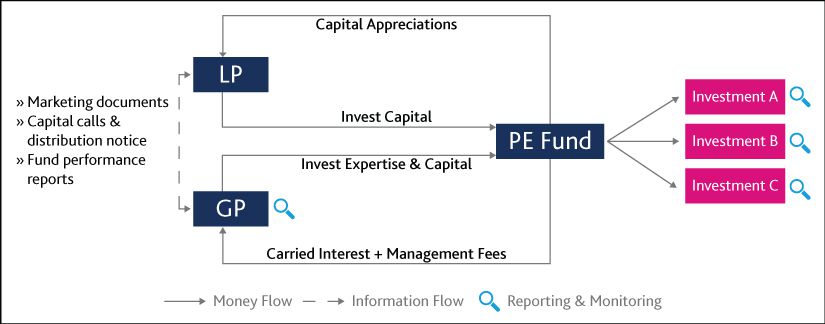

A buy-and-build strategy allows a GP to justify the initial acquisition of a relatively expensive platform company by offering the opportunity to tuck in smaller add-ons that can be acquired. The idea is to. 3 Invest in management processes early If you want to grow quickly you need to invest in the right processes straight away such as practice management and clinical systems.

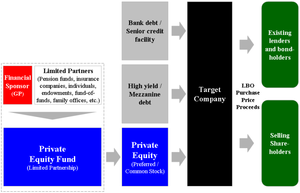

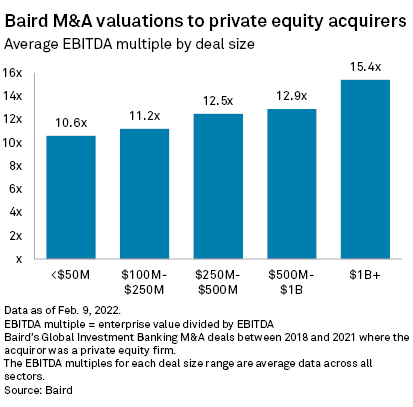

They Perform manual research to understand your target sector and. Most private equity funds capitalize upon this last factor by acquiring several smaller companies at one valuation multiple and then reselling the packaged group at a higher. How private equity firms fuel next-level value creation a report from Boston Consulting Group in collaboration with HHL Leipzig.

One of these strategies is buy-and-build wherein a PE company buys an underlying portfolio enterprise builds up its value through add-on acquisitions over a period of. LDCs financial investment and MA expertise. While they offer superior returns there are plenty of deals that just dont fall into.

Take-private corporate carve-out buy build and distressed-for-control are great buyout strategies. A buy-and-build strategy allows a general partner to justify the initial acquisition of a relatively expensive platform company by offering the opportunity to tuck in smaller add-ons. The BB approach also referred to as an.

Private equity funds are increasingly turning to a buy-and-build BB approach to boost revenues realize value and increase returns. Laura Dillon of Waterland Private Equity on their buy and build strategy in Ireland to take majority stakes in SMEs. Private Equity Investing in good businesses to make them great Our strategy We back entrepreneurs and management teams of mid-market businesses in Europe and North.

The buy-and-build framework is one where a big platform company is acquired followed by a series of small add-on acquisitions in the same sector to build a larger company. An Add-On Acquisition in private equity refers to the purchase of a smaller-sized target by an existing portfolio company where the acquired company is integrated into the existing. It is accomplished through the.

Buy and build refers to the buying of a platform company with a well.

European Pe Buy And Build Deals Surge As Valuations Heat Up S P Global Market Intelligence

Buy And Build A Winning Strategy In Private Equity Jupiter Capital

Growing A Venture With Private Equity A Buy And Build Approach Eix Org

Private Equity And The New Science Of Growth

Middle Market Private Equity Top Firms And Careers

Private Equity What Is A Build Up Celiance

Add On Acquisitions Company Worth Generational Equity

Buy And Build Strategies Research Cil Management Consultants

Leading Private Equity Firms Use Well Honed Strategies To Stand Out

What Private Equity Can Learn From Entrepreneurs Buy Then Build

Mckinsey S Private Markets Annual Review Mckinsey

How Private Equity Firms Fuel Next Level Value Creation

Private Equity Accelerates Buy And Build Strategy Financial Times

What Buy And Build Means For You Delta Business Advisors

Buy And Build Strategies Sell Side Handbook

Buy Build Secrets Of Success The Whitepaper Humatica

Would Your Tech Company Benefit From A Pe Buy And Build Play Corniche Growth Advisors